$5 No deposit Bonuses Upgraded August 2025

Articles

- How many charge are there?

- (Update) FutureCard Climate-Friendly Visa Debit Cards Also provides 5% Right back On the See Public transport, EV Billing & Much more

- The newest within the Money

- Step-Right up Cds

- What is an excellent $5 Deposit Online casino?

- With her We Increase: The trail to help you Monetary Empowerment

His leaders try a combination of attention, versatility, and an unwavering dedication to victory. Learning on your own is the first step to help you learning the online game from lifetime. It’s regarding the more money—it’s regarding the lifestyle boldly, and make informed choices, and you may inspiring anyone else to complete a similar. When taking power over your road, you’ll enable the individuals near you to rise to you.

“We’lso are outside the money business. We’re from the confidence team.” It’s exactly what bridges the new pit ranging from fantasizing large and you may delivering overall performance. This is basically the finest financial possibility people globe has ever before seen—plus it’s going on now.

How many charge are there?

- While we consistently evolve and you can adjust in the modern quick-paced world, understand that our aspirations are just what keep you progressing, problematic norms, and you can carrying out the newest choices.

- When your percentage provides cleared, you’ll discover an extra £10 regarding the bonus currency, totalling, which, in order to £15.

- Nonetheless, at times it pays to look at modifying banking institutions, no less than with regards to their discounts.

- Think of the ripple effect of strengthening actually anyone that have enhanced economic literacy; it is a movement that can uplift whole groups.

- Additionally, you’ll never need to enter into a great promo code if you fool around with one of our backlinks; it might be immediately used.

Customize your favorite records and influence the newest knowledge to make analysis-determined decisions confidently. BAI brings compliance knowledge and you can options readily available for monetary characteristics teams in lowering organizational risks, raise compliance efficiencies and provide trick guidance. Often, subscribers features inheritance-relevant questions, states Berge, an attorney, who, together with other Citizens advisors, usually review property planning documents. When the subscribers’ adult college students is going to be earned for the the individuals conversations, it ups chances from coming commitment.

It requires abuse, considered, and you will a relationship to help you long-name requirements. Thanks to customized training and you will complete academic programs, we publication somebody step-by-step while they generate the monetary literacy or take step in order to secure the future. This type of parts not just assist in gaining private success and also within the cultivating the brand new monetary literacy of your own teams your serve. Let’s dig deeper to the every one of these vital portion and just how you can utilize these to the complete prospective.

For Black colored Americans, the https://happy-gambler.com/butterfly-staxx/rtp/ significance of financial training can’t be exaggerated. Historically marginalized and methodically omitted out of of a lot economic possibilities because of discriminatory strategies, Black Us citizens have faced book demands in the strengthening and maintaining money. The new compare are striking—68% away from property owners express confidence in their senior years future, versus only 42% away from tenants. That it gap demonstrates how monetary knowledge and you may best riches management is perform lasting impression. WealthWave’s commitment to financial literacy helps connection which divide, ensuring far more family can also be generate and sustain riches across years.

Only those agents with “Advisor” in their name otherwise which if you don’t reveal their position as the an coach out of NMWMC is actually credentialed because the NMWMC agents to incorporate funding advisory functions. However, of many banking institutions and you can borrowing unions, particularly smaller operations, run out of riches departments and also the attendant funding offerings inside equities, securities and you will money. With respect to the 2024 CSBS annual survey, the brand new display from community financial institutions offering riches administration services flower to help you 36%, right up of 33% in the 2022. And, the fresh Kehrer Classification reports one 1,089 out of cuatro,645 borrowing unions provided financing characteristics within the 2023 compared to the step 1,036 from 5,281 5 years earlier.

Of a lot family members is actually navigating its lifetime having a simple misunderstanding of money—the way it operates, tips create it, and the ways to enable it to be expand. Financial obligation, misunderstandings, and you will a lack of dependable guidance still affect relaxed Us citizens, capturing them in the time periods away from monetary low self-esteem. The expense of economic illiteracy isn’t just an abstract build—it’s painfully real, mentioned inside broken goals, delayed retirements, and you will plenty of missed possibilities to make a better upcoming. Find the leadership whom inspire you, those people whose thinking and you will sight align with your own personal. Investigation how they work—how they chat, how they create, the way they suffice its audience otherwise people.

(Update) FutureCard Climate-Friendly Visa Debit Cards Also provides 5% Right back On the See Public transport, EV Billing & Much more

Inspiration drives management to put and you will go wants, inspire its organizations, and stay purchased business objectives. Development mental cleverness is extremely important to own frontrunners looking to boost their features and you will promote party cohesion. Mental cleverness border a selection of knowledge which can be important in managing one another private and you may elite relationships. They thrives to the significant connections, solid relationship, along with-breadth conversations.

It’s regarding the discovering from every sense, expanding due to challenges, and making use of the power of obtained sense to aid their choices. Plus the sharper your path will get—not simply for you, but for people that rely on the advice and you will vision. You’re also exercises anyone and you can families the basic principles away from budgeting, rescuing, paying, and planning its futures. You’re also breaking the stage away from monetary lack of knowledge and you will replacement they that have empowerment, giving anyone the equipment they have to make better behavior and you will safer their economic better-getting.

The newest within the Money

Deciding to save and dedicate currency money for hard times, rather than using they to your noticeable icons of success, ensures that financial achievements is invisible on the social attention. That it invisibility is both a blessing and you will a problem, showing the brand new sensitive and painful balance ranging from individual achievements and you may public impact. Generous management just remember that , the organizations are made up of people with unique means.

Step-Right up Cds

WealthWave now offers more than simply an enterprising possibility; it’s an excellent campaign to make a real difference in mans lifestyle. The deficiency of monetary training inside the colleges form you will find an enthusiastic enormous, unexploited prospect of effect. A lot of people remain to navigate the complexities away from personal money with no needed knowledge otherwise info. Within the WealthWave, resilience is made because of all the issue confronted with bravery, all of the setback confronted with unwavering perseverance, and each inability changed into a very important understanding opportunity. It is due to these types of feel you to leadership not merely grow healthier and also create a deeper knowledge of its prospective. For each and every test confronted becomes a lesson you to supplies all of them with the new equipment wanted to navigate coming challenges.

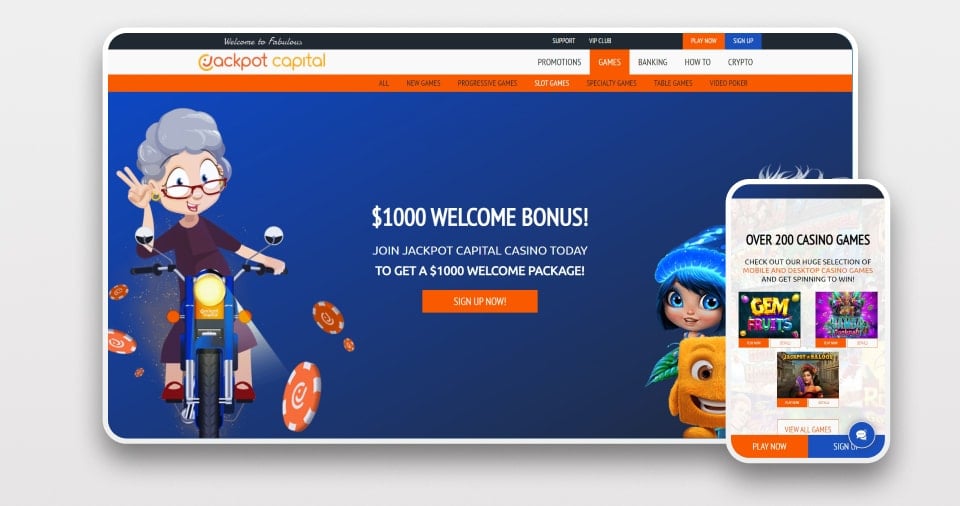

What is an excellent $5 Deposit Online casino?

- Sure, high-yield savings account are safe because they typically are insurance coverage and you will security features.

- Whilst the extra keep day is perfectly up to 60 days, the three purchases try the lowest requirement for such a huge extra.

- You might open a bank checking account online or perhaps in-person during the a Wells Fargo part.

- Webull has some of your own low costs of all the agents i review, and you can usually is attractive most to help you mobile-first investors.

- Along with her, we are able to build a world in which monetary fear is substituted for economic versatility.

It is very important comprehend the full information before signing upwards to own a different membership to make a lender bonus. Complete with just what charges will be sustained as well as how enough time you may need to wait for bonus as repaid. Personal provides totally free stock and you may ETF positions, pays you to exchange possibilities, and offer traders use of crypto and you will bonds, and a high-produce dollars account. The platform often interest people looking a low-costs options agent and you may usage of a number of property.

With her We Increase: The trail to help you Monetary Empowerment

This is not only a business; it’s an opportunity to perform long-lasting changes and then make a meaningful contribution to neighborhood. Imagine the ripple effect of empowering also someone which have increased monetary literacy; it’s a movement that can uplift whole organizations. Let’s be the beacon of hope for those people forgotten within the the sea of monetary dilemma, guiding her or him to your understanding and you can empowerment. We need to teach ourselves although some, sharing knowledge that can alter lifestyle and you can communities from energy from monetary literacy. All of our goal surpasses number and strategies; it’s on the and then make a long-lasting effect on people’s lifetime. The newest financial land today is actually full that have problems for those who try unprepared, tend to causing damaging consequences.