Creating a Narrative from Numbers

Business plans are a pivotal part of the strategic financial decision-making process. They help put thoughts down on paper, present market data to back up the rhetoric, and articulate the financial side of an argument. When it comes to business plans, it’s not only about the numbers; the narrative and the assumptions used to drive them is just as important, if not more important. There is an art to getting the story and the numbers right, and it’s not a process that can be “gamified.” However, there are common pitfalls that, if avoided, can increase the chances of success.

Scenario #1: Consistency, Consistency, Consistency

The most common error in business plans is the lack of consistency. In my experience, this is never intentional but comes as a consequence of how business plans are written. This is usually a result of different teams taking charge of different sections and working in silos, or through disconnected interactions with senior management. A business plan should read like a story. For example, insights gathered from the market and competition sections should be reflected in assumption drivers of the financial budget section.

Knowing how to engage the insights of the senior management team is critical. If you involve them too much in a business plan, the process can get tediously slow, but if you work too independently, then your final output may take a dangerously wide tangent.

What worked in my experience was to set up short meetings with leaders of the departments involved – after completing the first draft – to gather their thoughts and insights. In one instance, we used this approach to build a review team of a target company – an internet services provider. The operations team identified an underutilized part of the target’s network, the marketing team identified how to utilize it, and the financing team identified 30% of unrealized value that could be unlocked.

A very common example is a business plan that promises aggressive revenue growth with limited investment in marketing or CapEx. If you make more products (or get more users) to sell, you will need resources to produce and sell them. There are some services that have zero marginal cost structures – like software – where such strategies may work, but more often than not, there will be a budget disconnect. Let’s look at a simple example from an income statement budget:

Exhibit 1: Model

The model assumes the following:

- Revenue to grow by 10% over the coming five years.

- Gross margin will remain constant for the foreseeable future.

- Overhead expenses will increase by USD 250 year on year.

- Marketing and other expenses will remain constant.

Let’s suppose that we look at the industry section of the business plan and discover that consultants expect the market of the company to grow at a CAGR of 5% over the coming five years.

Our company’s budget assumes that its revenue will grow at a rate double that of the industry with a very limited investment in overhead and marketing expenses. This presents a break in the narrative—to grow at a higher rate than the market, you must take market share from other competitors, which (in a fair market) requires some form of investment. This investment could be into people, marketing channels, or in some other form of competitive advantage. The point to make is that the current presentation of data constitutes a break in the narrative, which will require good arguments to support.

Now, suppose that the consultants expect the market to grow at a CAGR of 20% over the coming five years. Well, the story now flips, and the company is set to underperform; the lower investment forecast now appears more logical. By spending less, the company will probably concede some of the market share, which is being taken into consideration in the growth forecast.

Scenario #2: Tunnel Vision

Another common pitfall is coming into a business plan process with a rigid mindset. While a business plan typically presents one scenario of how things will unfold in the future, feel free to explore other options as you build the plan and do not stick to one approach. Use the financial model and market research to explore what other possible paths the business can take. Use the financial analysis to explore other areas: for example, a pivot into a subscription model, or using tiered pricing. The plan gives you an opportunity to explore the impact of your strategy on other dimensions of your business, such as net working capital and CapEx.

In one case in a prior job, we had a manufacturing client that was looking to expand his operations massively, and he believed that the business would grow significantly over the coming years. The client planned to use the business plan as part of a transaction that would include selling a portion of the business. After conducting our analysis, we presented our findings to the client. The growth the client desired was not only unsupported by external market research but it would destroy value for the client. The net working capital investment was so significant that it would more than wipe out any benefit produced by revenue growth.

We helped the client rethink both his business plan and exit strategy. The analysis we provided identified other areas in the market that he could consider growing into, and that optimizing working capital should come before any significant growth efforts into the core business.

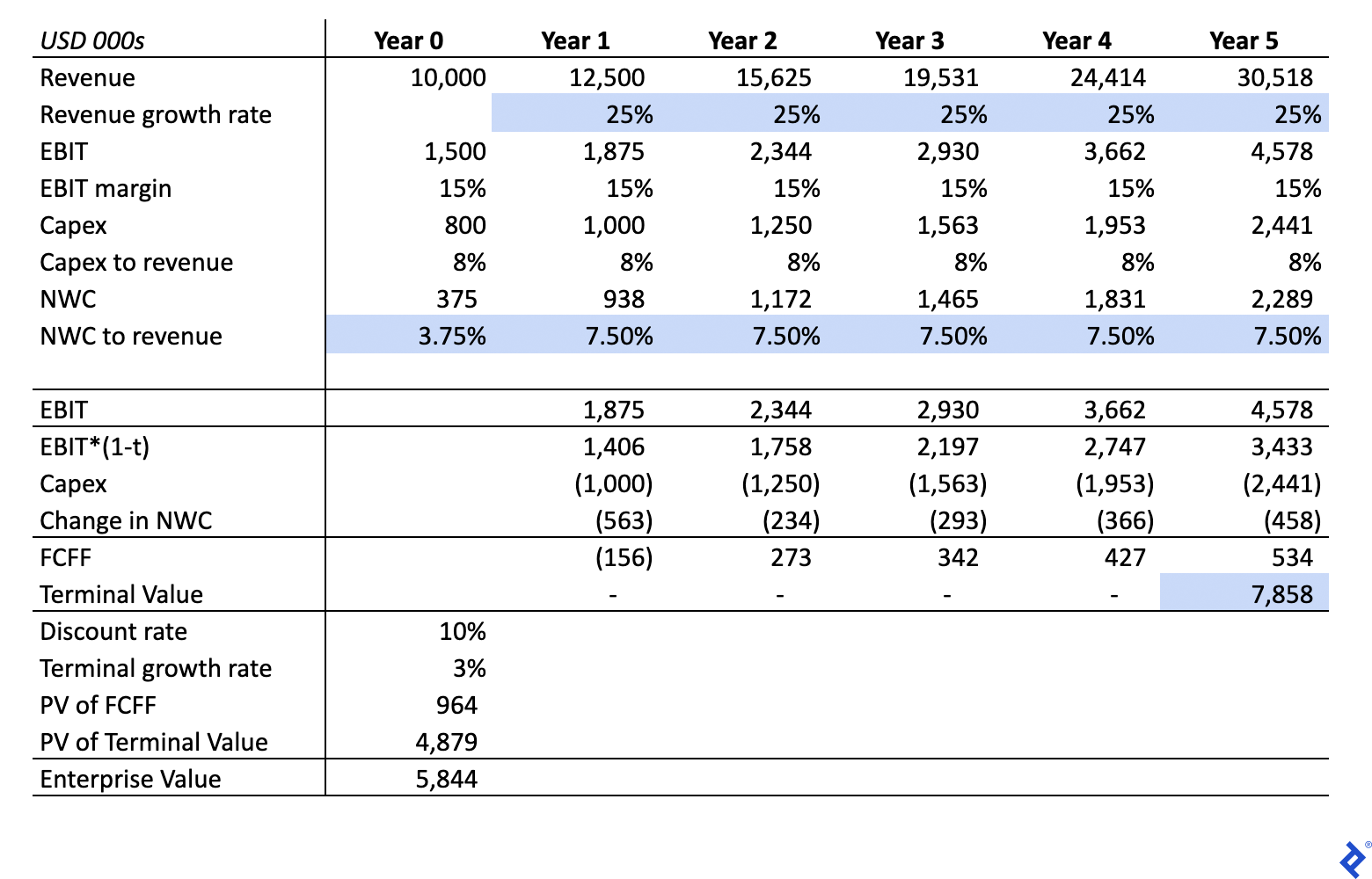

Initial Business Plan Provided by Client

Revised Business Plan

Note: The terminal value was arrived at using the perpetual growth model using a 3% terminal growth rate and a 10% discount rate.

As you can see from the tables, the final enterprise value in the revised plan is higher than in the client’s original. The only difference between the two is the revenue growth rate and the net working capital assumption. The original narrative was that the company sought aggressive growth and was therefore willing to invest heavily in its working capital to achieve it. However, the growth would end up costing the company more harm than benefit. While the narrative is clear, its implications were not fully thought out. Of course, there are other arguments that can be used. As an example, the terminal growth rate used in the first scenario could be higher or use a scenario where the current growth rate of 25% would linearly converge to 3% (H-model). These could be valid arguments, but you must substantiate them in your plan and provide the logic and data that support them.

Scenario #3: I Did It My Way

There is no right or wrong approach to building a business plan, so take your time; think about the idea and lay out a solution and a structure that has logic. If you are disrupting an industry, the focus should be on how your product is different from that of your competitors and what that means for the end customer. On the other hand, if you are looking to enter a regulated market, then you need to understand the laws and regulations that you intend to overcome. Pick an approach that works for you and will help you achieve your goal.

In one case, I worked for a client that was trying to launch an eCommerce business. The client was very focused on developing a detailed model for the business and used a return metric to evaluate the viability of the investment. Most eCommerce businesses are loss-making and take significant time and investment before becoming economically viable. I helped the client see why his current method may not help him get the desired result and shifted his focus toward understanding the opportunity cost of not starting the online business, and what it would take for him to build a profitable one. These were questions that we could answer much more reliably and provide the client with realistic data points to determine the required investment and the type of operations required to generate an attractive return.

Let’s look at an example of this scenario. Suppose that the total retail market size (including offline and online channels) is $1 billion, and projections estimate that eCommerce penetration will increase to 10% over five years and offline margins will decline by 5% due to eCommerce competitive dynamics. If your market share is 30% (i.e., your annual revenues are $300 million), then you risk losing 10% in market share and another 5% in margin. So your total loss is around $35 million annually. This is not a precise calculation and should be supported by further research, but it does give you a grasp of what you are at risk of losing. It gives a different perspective of your narrative and can help you close some of the gaps in your analysis.

Numbers <> Real Life?

There are certain norms about business plans and projections that continually prevail. Most prominently, that they are expected to present an optimistic (yet realistic) view of how the business can unfold. Keeping that in mind, have a think about what your numbers mean in real life. If you assume the price of products and margins will continue to improve, what will stop competitors from offering lower prices and getting a lower margin from you? If you are in a platform business and you assume a declining customer acquisition cost, how are you going to maintain your customer base and add to it? An often neglected part of a business plan is return measures, such as return to equity and return on invested capital. They do not have a necessary function within the plan but can be a great way to sense check your assumptions.

Building great business plans takes as much art as science. The essence of a business plan is the narrative of your business and the thought process behind it. If it feels overwhelming, just remember the words of Charles Munger: “It’s not supposed to be easy. Anyone who finds it easy is stupid.”

Source: toptal