Handbook: Internal control over financial reporting

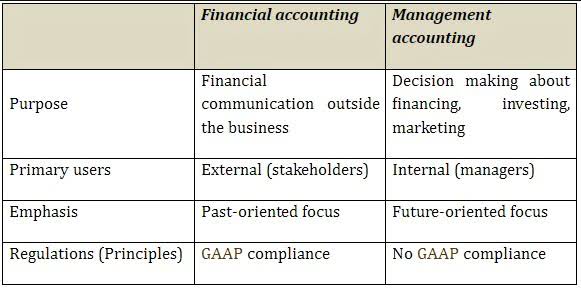

The importance of internal control when it comes to fraud prevention can not be overstated. While it is true that no system is perfect, and therefore guarantee total protection against fraud, a thorough system of internal control measures significantly reduces fraud risk overall. Internal controls accounting aims to manage financial practices efficiently. gym bookkeeping It ensures fairness, follows laws, and protects against financial mishaps. These processes are crucial for keeping stakeholders’ trust and the organization’s long-term success. They assure that financial information is accurate, aiding smart decision-making.

Business and Manual Process Control Monitoring

- Internal control can be an effective measure that companies adopt to guarantee correctness in the information provided.

- Internal controls also ensure that financial statements are accurate and that company assets are protected.

- Enron was one of the largest energy companies in the world in the late twentieth century.

- Consistent monitoring, assessing, and corrective action for internal control deficiencies lead to tremendous success in risk management.

- Examples include reconciling bank accounts, counting cash, restricting access to accounting systems and requiring multiple approvals for large payments.

This lets them fix issues quickly and improve processes while keeping financial records accurate. It’s vital for lowering risks related to financial transactions and accounting fraud. By dividing tasks among different people, it’s harder for one person to both commit and hide mistakes or fraud. Personal integrity and ethics are key for internal controls and business management. They stop accounting fraud and make sure everything runs as it should each day. Internal controls are important to ensure the companies work effectively and efficiently while complying with the standard rules, laws, and regulations.

What role do physical controls play in safeguarding assets?

- Double-entry accounting is the foundational principle for the modern accounting system.

- Continuous improvement keeps controls working well, even as risks and regulations change.

- These globally recognized standards help businesses manage operational risks, demonstrate due diligence, and ensure regulatory compliance across industries.

- Furthermore, it integrates the controls into the business activities and makes the procedure transparent and ethically sound.

Examples include validation checks on data entry and system-based access controls to prevent unauthorized use. Regular reconciliations involve comparing different sets of data to ensure consistency and accuracy. For example, bank reconciliation compares the company’s cash records with bank statements to identify any discrepancies or unauthorized transactions. This control ensures that no one person has control over all aspects of a financial transaction. For example, the person responsible for approving purchases should not also be responsible for recording the transaction in the accounting system.

Guidance on Monitoring Internal Control Systems (

A strong financial control system has three key parts – preventive, detective, and corrective controls. These controls help protect against fraud, keep things running smoothly, and make sure financial reports are right. Knowing and using these controls are crucial for managing risk and following rules. The first thing to ensure that the companies’ controls work perfectly is an appropriate control environment. This is what sets the conscious levels, making everyone from top management to staff members follow and keep a check on the policies, procedures, principles, and technology internal control accounting definition deployed.

NIST SP 800-61 Revision 3: Complete Guide to the New Incident Response Framework

In most cases, the owners are fully engaged in the business itself, and if employees are engaged, it is usually within the capability of the owners to remain fully aware of transactions and the overall state of the business. Facilitate effective operation by enabling it to respond in an appropriate manner to significant business, operational, financial, compliance and other risks to achieve its objectives. This includes safeguarding of assets and ensuring that liabilities are identified and managed. Your organization has the power to choose the framework that aligns best with your specific needs and regulatory requirements.

Effective internal control implies the organization generates reliable financial reporting and substantially complies with the laws and regulations that apply to it. However, whether an organization achieves operational and strategic objectives may depend on factors outside the enterprise, such as competition or technological innovation. The Chief Executive Officer (the top manager) of the organization has overall responsibility for designing and implementing effective internal control. More than any other individual, the chief executive sets the “tone at the top” that affects integrity and ethics and other factors of a positive control environment. In a large company, the chief executive fulfills https://themacmachine.com/online-bookkeeping-services-first-month-free-rbo this duty by providing leadership and direction to senior managers and reviewing the way they’re controlling the business. Senior managers, in turn, assign responsibility for establishment of more specific internal control policies and procedures to personnel responsible for the unit’s functions.

Management, particularly the CEO and CFO, is responsible for designing, implementing and monitoring the system of controls. The board, often through the audit committee, oversees this process to ensure compliance with laws, regulations and ethical standards. External auditors and internal audit teams play a supporting role by evaluating the controls’ effectiveness, but accountability ultimately rests with leadership.

- Companies like Microsoft Corporation prove how vital it is to have strong control over their finances.

- They help assure stakeholders that the company operates responsibly and ethically and that its financial statements are reliable and accurate in accordance with accounting regulations (e.g., Sarbanes-Oxley Act).

- The penalty is more severe for securities fraud (25 years) than for mail or wire fraud (20 years).

- These controls are designed to safeguard your company assets, maintain the accuracy of your financial records and and prevent errors and irregularities.

- Testing of internal controls includes making inquiries to management and employees, inspecting source documents, observing inventory counts, and actually re-performing client procedures.

- These controls must provide reasonable assurance that transactions are executed with proper authorization, assets are safeguarded, and financial records accurately reflect the company’s activities.

Understanding these limitations doesn’t diminish the value of internal controls but helps organizations develop realistic expectations and appropriate risk responses. For example, with a less committed and more relaxed tone, lower level employees are less likely to properly follow the internal controls in place. The financial reports and internal control system must be audited annually. The cost to comply with this act is very high, and there is debate as to how effective this regulation is. Two primary arguments that have been made against the SOX requirements is that complying with their requirements is expensive, both in terms of cost and workforce, and the results tend not to be conclusive. A robust internal control system consists of interrelated components that ensure operational effectiveness and regulatory compliance.